In this blog post, I will be talking about the credit score factors and why credit scores are important.

Disclaimer: I am not a financial professional, I am not telling you what to do with your money. This post is for educational purposes about credit scores factors.

Before we get started on credit score factors, let’s talk about credit scores!

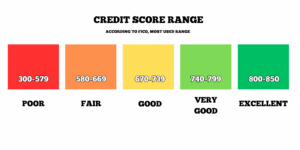

Your credit score is a number that ranges from 300 to 850, and it shows how likely you are to repay borrowed money. The higher the score, the better, because it indicates to lenders and credit bureaus that you are a low risk for them to lend money to. This is super important because a higher credit score means a higher chance of getting approved for loans with better terms, like lower interest rates. This can save you a lot of money in the long run when making big purchases, such as a car or a house!

Credit scores typically fall into these ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

As a new credit card holder, you’ll likely start with a fair score within a decent range. If you have bad credit, don’t worry! You can always build your credit with consistency and responsible credit use., but learning about the credit score factors can help you get there. Now, let’s dive into how you can build your credit!

How do I build my credit?

Your credit score is determined by five key factors, and each of these factors is weighed differently in terms of how they impact your overall score.

Let’s start with the factor that has the biggest impact on your credit score and work our way down:

Credit Score Factor #1: Payment History (35%)

Your payment history makes up 35% of your score. This refers to your ability to pay off your credit card in full each month when your bill comes due.

I want to emphasize in full because there’s a misconception that carrying a balance can help boost your score—but it actually hurts you! Carrying a balance can lower your score and may result in interest fees on the next month’s balance.

Remember how I mentioned that credit cards need to be used responsibly? Here’s the biggest tip I can give you: treat your credit card like a debit card. Only spend what you can afford to pay off in full when the bill arrives.

Credit Score Factor #2: Amounts Owed (30%)

Amounts owed accounts for 30% of your credit score. This measures how much of your available credit you’re using—referred to as your credit utilization ratio.

For example, if you have a credit line of $1,000, this means you can borrow up to that amount. However, it’s not recommended to max out your credit limit. If your monthly bill shows that you’ve used 100% of your credit line, it signals to lenders that you might be a risky borrower.

To avoid being seen as a risky borrower, aim to keep your credit utilization below 30% of your credit limit. In this example, that means using no more than $300 at a time when your monthly bill is due.

Tip: While 30% utilization is the general guideline, lower is better! Ideally, aim for 10% or less to show you’re a responsible borrower. Just remember to use your credit card at least once a month—not using your card can temporarily lower your score, as lenders want to see active credit usage.

Being mindful of your credit usage throughout the month can take practice, but it’s a crucial step in building and maintaining a healthy credit score.

Credit Score Factor #3: Lengths of Credit History (15%)

Length of credit history accounts for 15% of your credit score. This factor considers how long you’ve had credit accounts open and the average age of all your accounts.

As a new credit cardholder, one of the best things you can do is keep your first credit card open for as long as possible. Choose a card you can use for everyday purchases and plan to maintain for the long term.

I recommend avoiding store credit cards unless you’re certain they align with your spending habits. These cards often encourage unnecessary shopping at specific stores, and I’ve seen people close them after overspending. Closing a card can hurt your score by shortening your average account age.

Tip: Websites like NerdWallet compare credit cards and help you find one that rewards the categories where you spend the most, such as groceries, dining, or travel. Choose a card that works for you and your financial goals!

Curious about which card I started with? I share my full credit card journey in this post—including what cards I’ve gotten over the years and how I use them.

👉 My Credit Card Journey: FirstGenGuide

Credit Score Factor #4: Credit Mix (10%)

Credit mix accounts for 10% of your credit score. This factor evaluates the variety of credit accounts you have, such as credit cards, loans, or other types of credit lines.

Having multiple types of credit with a strong payment history and responsible utilization shows the credit bureaus that you are a reliable borrower. However, this takes time to develop. If you’re new to credit, I recommend starting with just one credit card and using it responsibly for at least a year or two before applying for another credit line.

Personal Tip: From my own experience, I’ve been able to build a great credit score with just three credit cards over the span of five years. It’s not about the number of cards you have but how responsibly you manage them.

Credit Score Factor #5: New Credit (10%)

New Credit accounts for 10% of your credit score. This factor is influenced whenever you apply for a new credit line, as all credit inquiries are reported to the credit bureaus. Each time you apply for a credit card, it results in a small dip in your score due to a hard inquiry.

If you’re asked to apply for a credit card with the promise of just “checking if you qualify,” be cautious—this can also impact your score. Anything requiring your Social Security number is likely to trigger a notification to the bureaus, and even if you’re denied, the hard inquiry remains on your credit report.

Opening too many accounts in a short period can signal to lenders that you may be a risky borrower. For this reason, I recommend waiting at least six months between opening new credit accounts.

Tip: Be strategic about when and why you open a new credit line. Only apply for credit that serves a purpose in your financial journey, such as earning rewards or building your credit history.

Now that we went over the five factors of your credit score, I will be sharing my tips and tricks with credit cards:

I am not telling you what to do with your money, just sharing my tips and tricks that worked for me to obtain a 700+ credit score.

Set It and Forget It: Why I Use Automatic Payments on My Credit Cards

Payment history makes up 35% of your FICO score, which is more than any other factor—so staying on top of your due dates is key. That’s why I always set my credit cards to auto-pay the full statement balance every month.

As soon as I get a new card, I connect it to my checking account and turn on the automatic payment feature. Sure, I could try to remember the due date each month, but let’s be real—life gets hectic. My statement balance is due on the 1st of every month (easy to remember), but sometimes I blink and it’s already the 3rd.

Auto-pay saves me every time—no interest, no late fees, and no hit to my credit. It also helps me build a consistent streak of on-time payments, which plays a huge role in keeping my credit healthy.

You Don’t Have to Wait Until the End of the Month to Pay Off Your Card

Here’s something I wish more people knew: you don’t have to wait until your statement is due to pay off your credit card. In fact, paying mid-month can help lower your credit utilization, which makes a big difference in your score.

Credit bureaus like to see you using less than 30% of your credit limit—but they love it when you use less than 10%. Of course, that’s not always easy, especially when you’re just starting out and your credit limit is low. But here’s the trick: your utilization is based on the balance that hasn’t been paid off yet, so you can make multiple payments throughout the month to keep that number down.

Also, like I mentioned earlier—keep using your older cards, even if they’re not your main ones anymore. A small recurring charge or occasional swipe keeps them active, which helps maintain your credit history.

Check out my other blog post, where I share how I still use my other cards!

👉 My Credit Card Journey: FirstGenGuide

Don’t Just Open Any Credit Card—Be Strategic

Be mindful about which credit lines you open. Personally, I avoid store credit cards. While they might offer in-store discounts or rewards, those perks often come with strings attached—like higher interest rates and rewards that only apply to that one store. They can also tempt you to spend more than you normally would, just to “get the points.”

And let’s be real—just because you love a store now doesn’t mean you’ll love it forever. If you stop using that card regularly, it might get closed due to inactivity, which could hurt your credit by impacting your overall utilization or credit age.

Before opening any card, do your research. Choose one that aligns with your long-term goals—not just what sounds good in the moment. Look for cards you’ll actually want to keep for years, because closing a credit line can temporarily lower your score. That said, if a card is doing more harm than good—like offering minimal rewards with high annual fees or encouraging overspending—I’d rather take the short-term credit score dip and close it.

Also—don’t feel like you need six credit cards to build strong credit. I’ve opened just three cards over five years, and that pace worked perfectly for me. Building credit is not a race. I even know someone who bought a home after years of responsibly using just one credit card.

And here’s something a lot of people don’t realize: student loans are a line of credit, and they do affect your credit score. Paying your loans on time can help build credit—but when you finally pay them off (which is the goal!), that account closes. That can cause a temporary dip in your score, especially if it’s one of your oldest credit lines. But honestly? I’ll take a small credit dip any day if it means I’m finally done paying off student loans.

Just a heads up: Late student loan payments can negatively affect your credit score. Loan servicers may report missed payments to the credit bureaus, which can lower your score and remain on your credit report for a while.

If you’re in repayment, it’s important to stay on top of your due dates—not just to avoid fees, but to protect your credit, too.

Ready to pay off your student loans? I’ve got a blog post for that—plus a free debt tracker to help you get organized and take action now.

Trust me—credit cards aren’t that scary when you know what you’re signing up for and stay aware of your finances. The truth is, a lot of people don’t, which is why credit cards get such a bad reputation. But I’m here to share what I’ve learned and how I managed to build a great credit score—because I had to figure it all out on my own.

Building a good credit score is a gradual process, and it’s perfectly fine to take things slow. Remember, while a good credit score takes time to build, a bad credit score can happen quickly—sometimes in just one statement—and it may take months to recover. I hope this blog post helps you feel more confident on your own financial journey. You’ve got this!